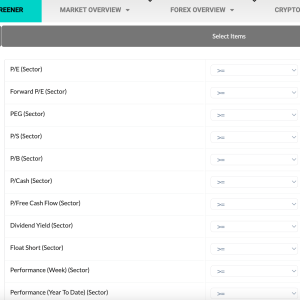

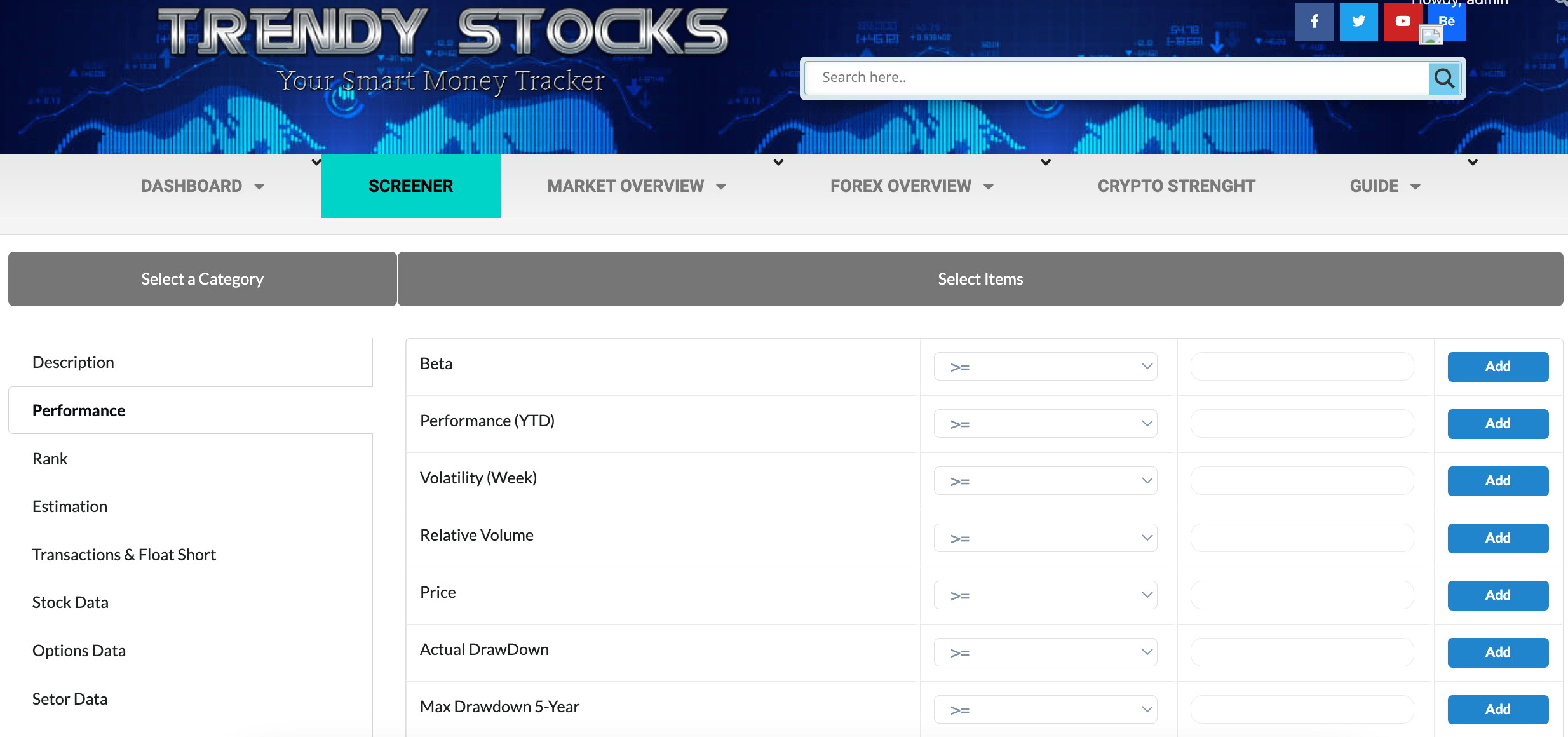

Our screener is undoubtedly one of the most powerful and complete on the web.

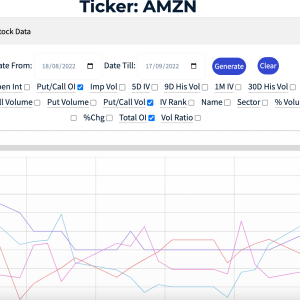

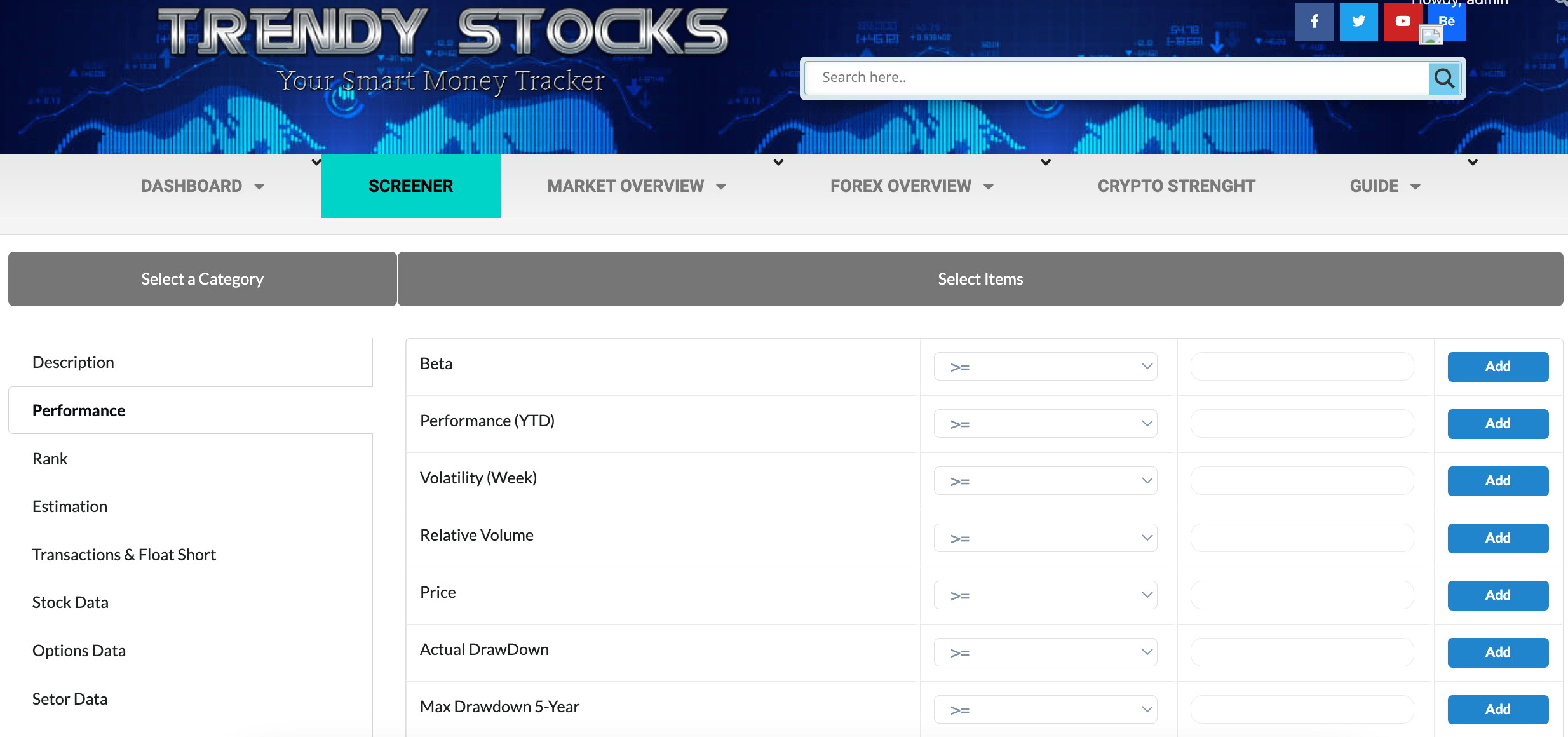

As with the Smart Money Tacker here too you can choose and combine almost 100 indicators, among those of options , fundamental , analyst estimates etc. You can use them individually or combine them to get confirmation from multiple fronts.

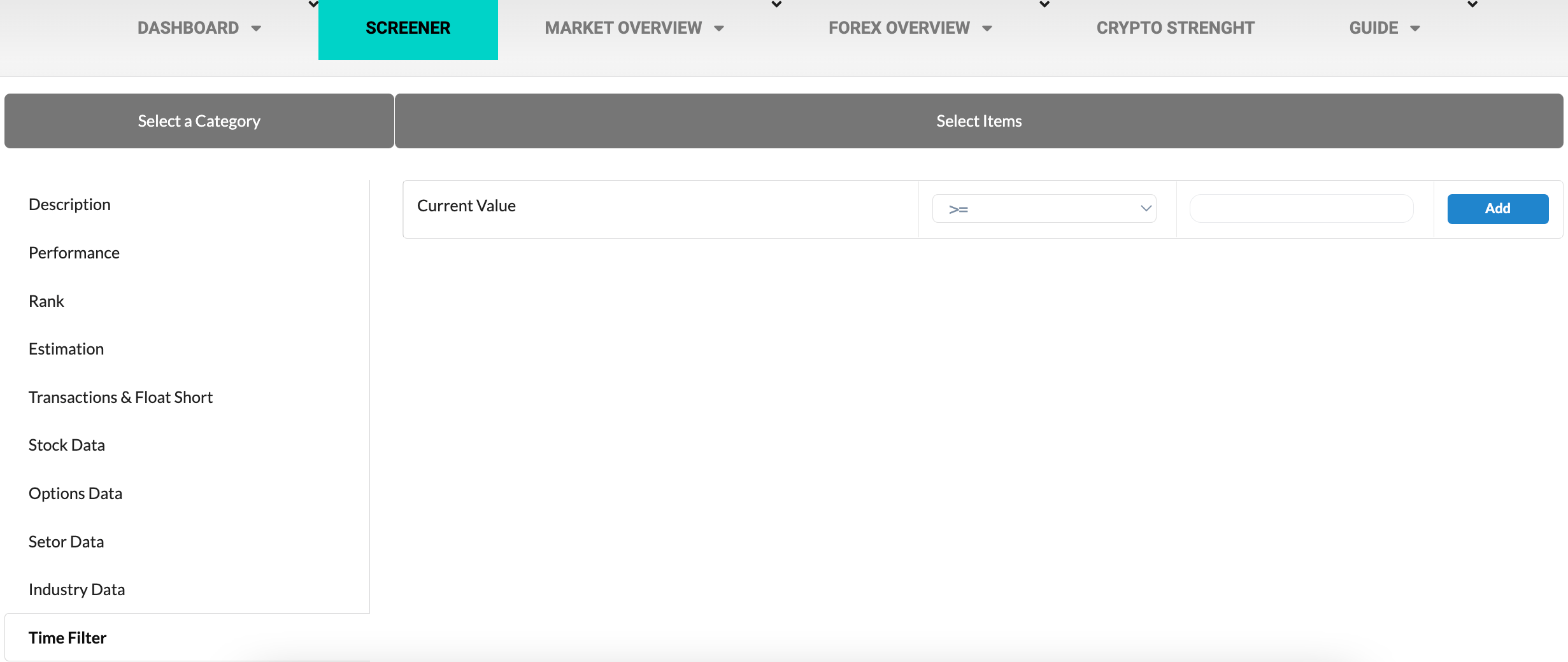

As you see it is very intuitive , just choose the parameter you want to use and choose if you want it greater equal > , smaller < , equal = or different <> from a value you choose, and press the add key , Once you have chosen all the filters you want you can click on Run Screen and you will see the companies that respect your parameters.

Now let’s talk about the two special filters that make our screener unique.

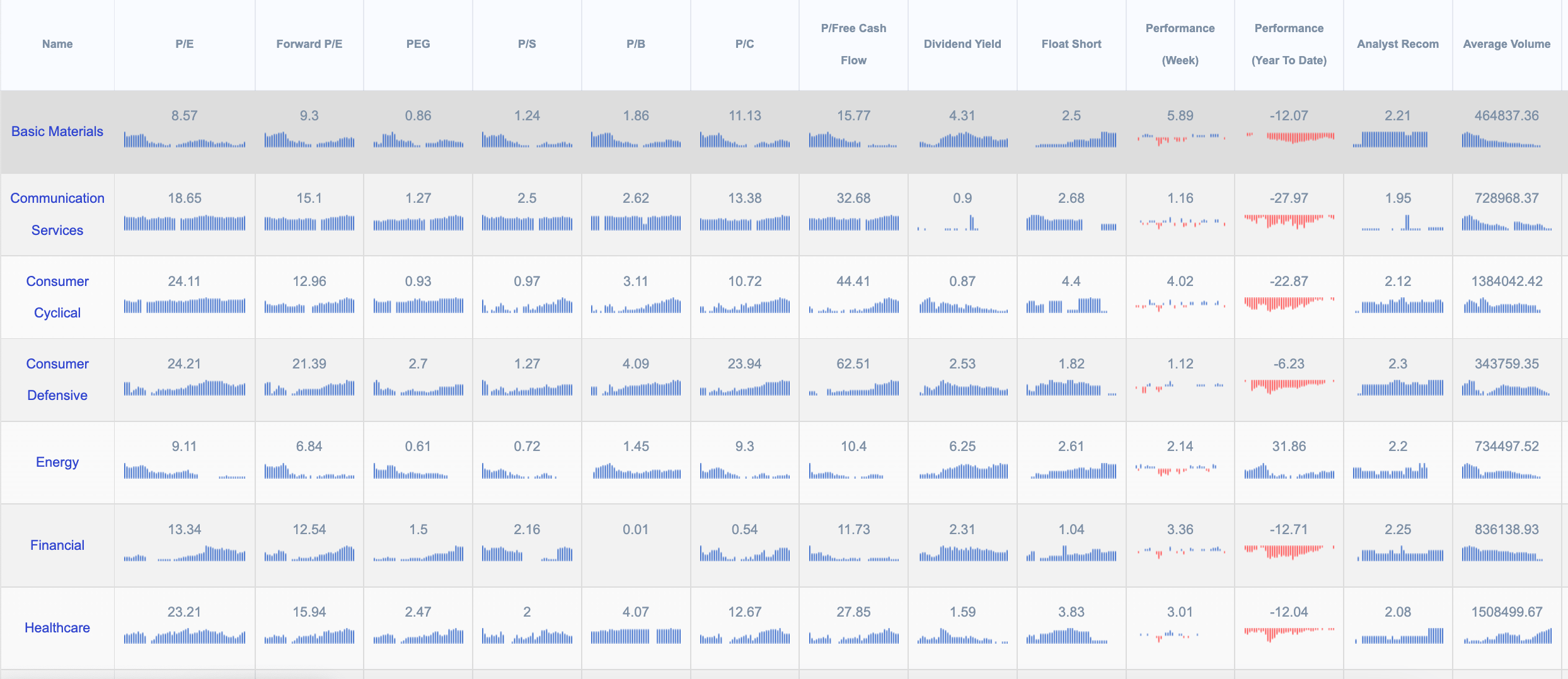

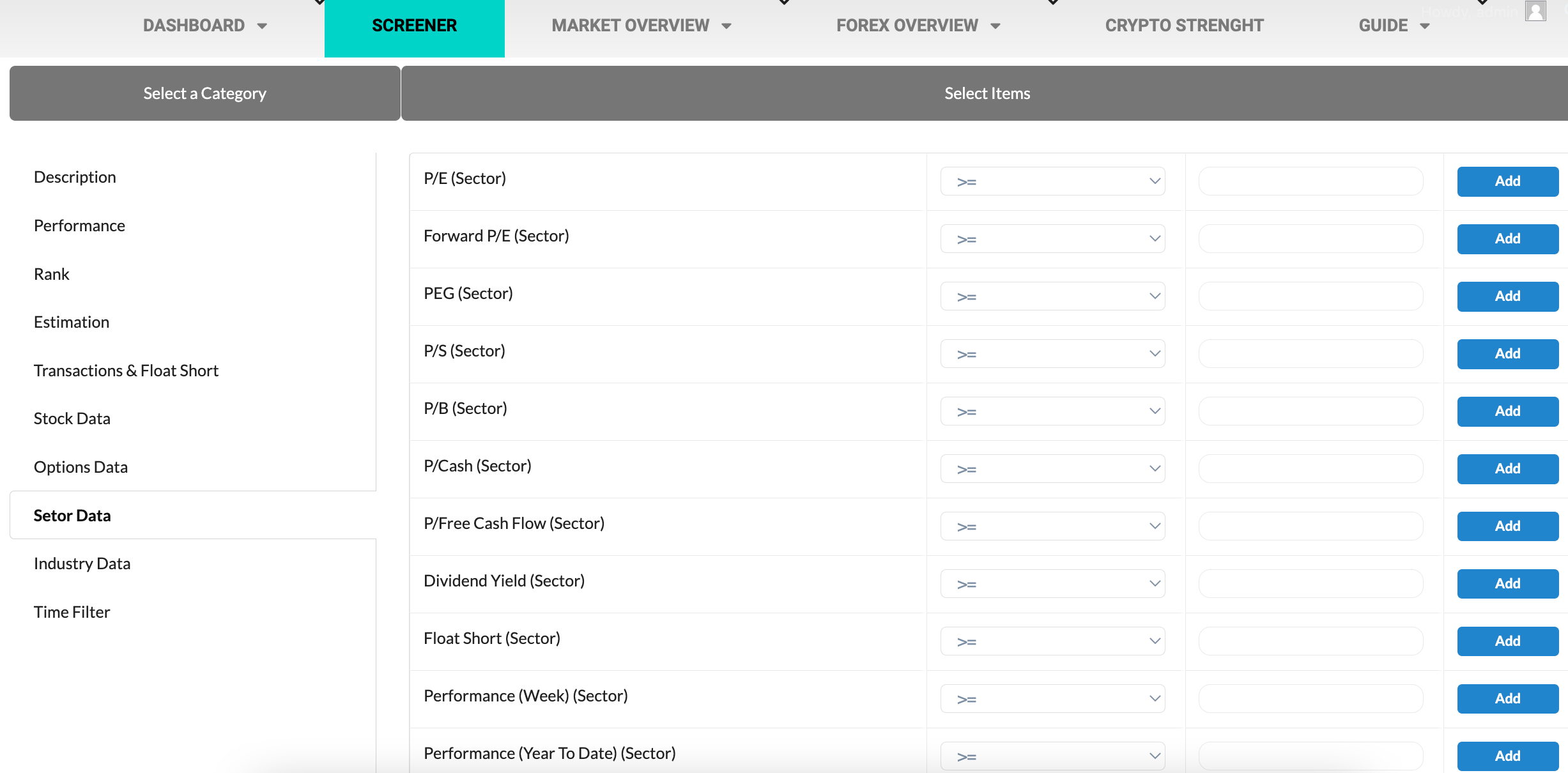

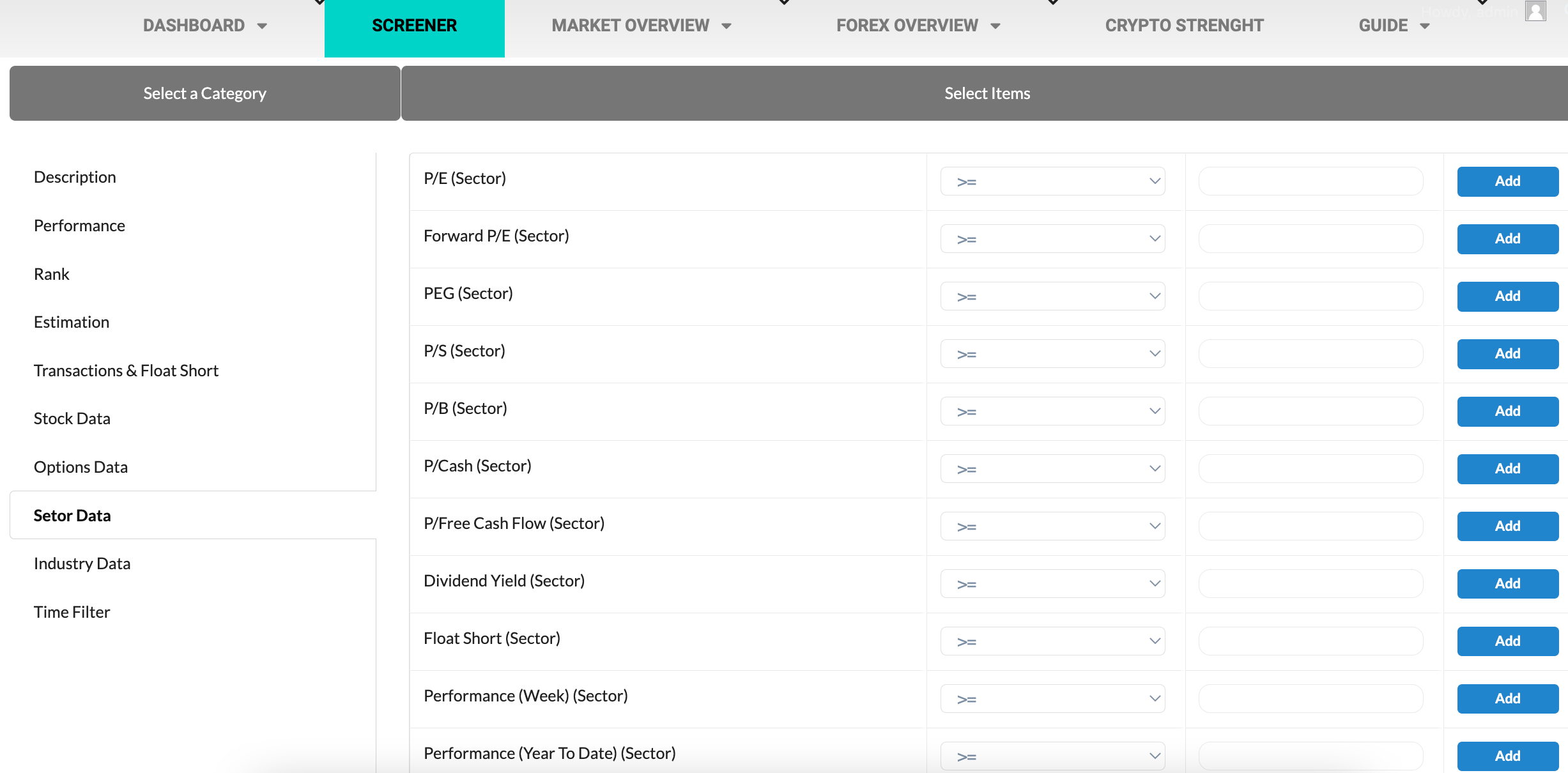

In the Sector data and Industry data sections you can filter companies only from sectors or industries that meet your parameters, for example you can filter companies that are in sectors that have a low float short , or have had positive performance or are recommended by analysts.

Then you can filter sectors and industries with two clicks without first analyzing or searching for the company you are interested in.

Making trades in the right industries and sectors will greatly increase the chances of profit.

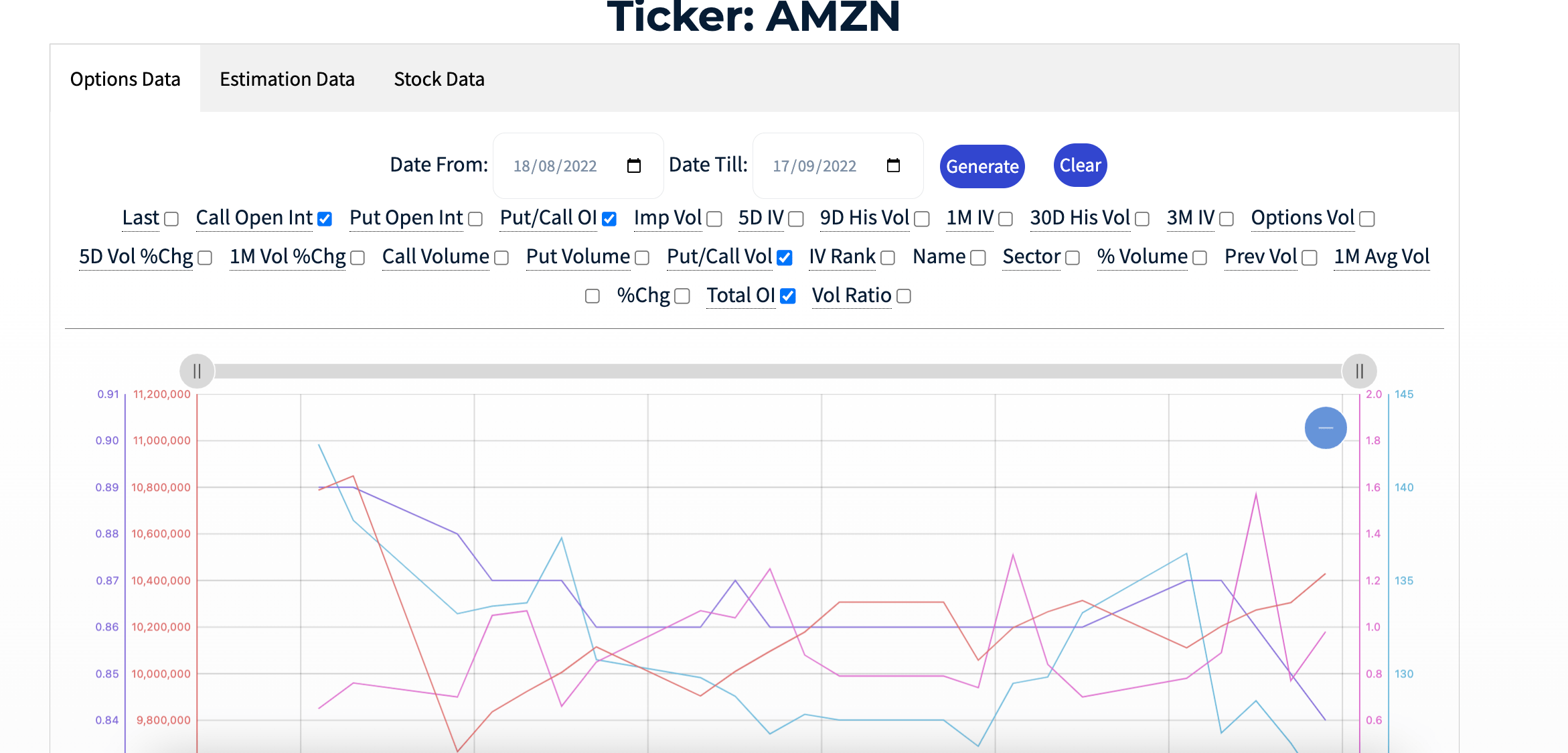

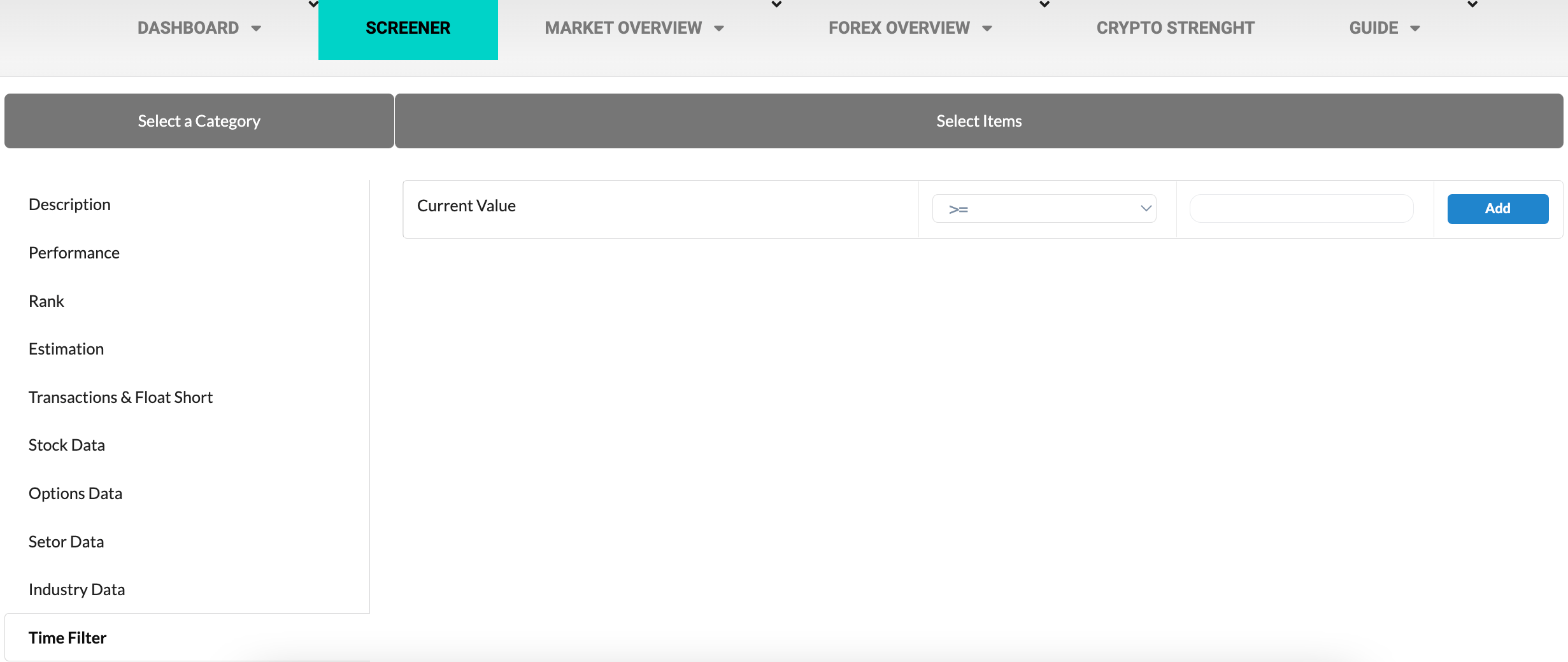

Second filter is the time filter you can find in the last section of the screener.

All the sceeners on the market allow you to find companies that have a certain value but if you want to know if that data is improving or worsening how can you do it?

For example to find stocks to low price but where the fundamental ones are improving so as to find the bottom of the trend, now you can do it.

How it works:

Select as many filters as you want from the other sections ( you can also assign neutral values using the filter <> from 0 , so you will not specify particular values but will find only companies that are improving or worsening)

Once chosen go to the Time Filter section, the filter takes the current value as a reference, or the last data present selects whether the current data must be greater than the same or different than a date you want.

in the last column of values enter the number of past days you want to compare current value with, then if you want to compare the current value with the 10 days ago just enter the value 10.

Let’s take an example to better understand:

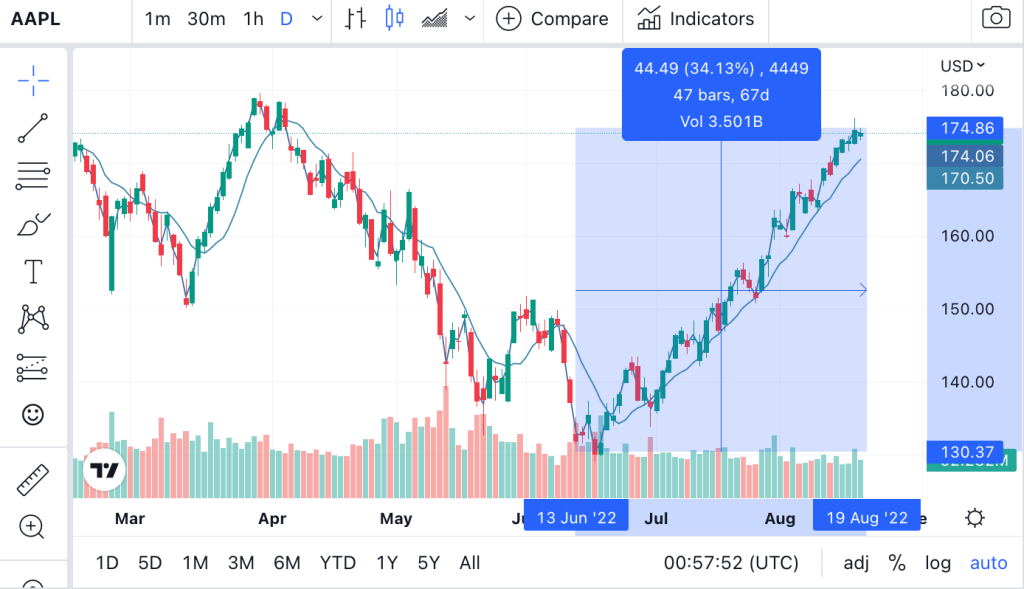

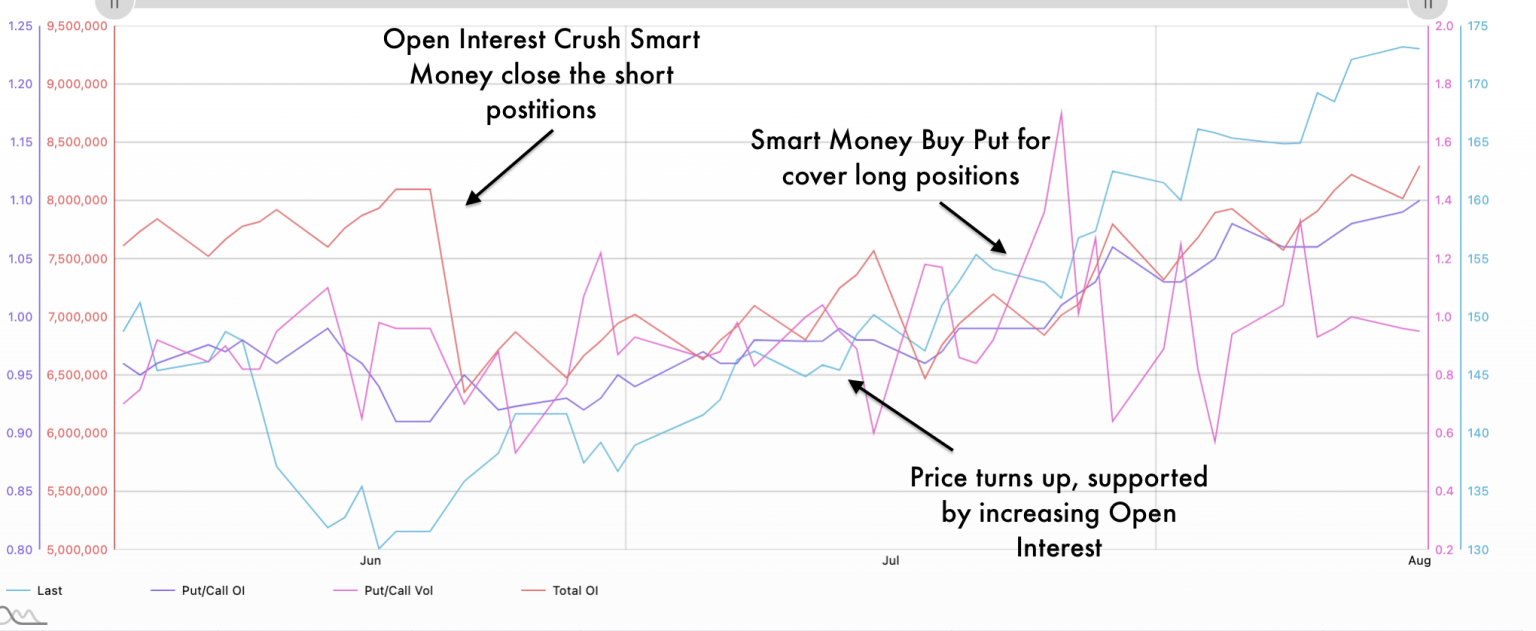

We want to find companies with a price higher than 10$ that have increased in value in the last 3 days and that this increase is supported by the growing open interest.

We go to the performance section and select Price > 10 then go to the Options data section , we find Total Oi, in this case we do not care that it has a specific value but only that it is growing so we insert the filter <> from 0 .

Once this is done go to the Time filter and select that the Current Value must be greater > than 3 days ago then enter the value 3.

Added all filters click on Run Screen and you will see all stocks that have a growing price and open interest in the last 3 days.

To discover the elements that make up the screener I invite you to visit our glossary by clicking here.